Credit cards, today, come as perhaps the most indispensable tool to handle expenses, earn rewards, or savor exclusive advantages in this fast-moving machinery of finance. What sets HSBC Credit Cards apart from the rest is their many diverse benefits, user-friendly experience, and reliability. Whether you travel a lot, like shopping, or dine out frequently, HSBC has it all, and the perfect card for anyone’s needs. In this guide, let’s dig into anything having to do with HSBC credit cards – features, eligibility criteria, and how to apply for them.

Benefits of HSBC Credit Cards in Comparison

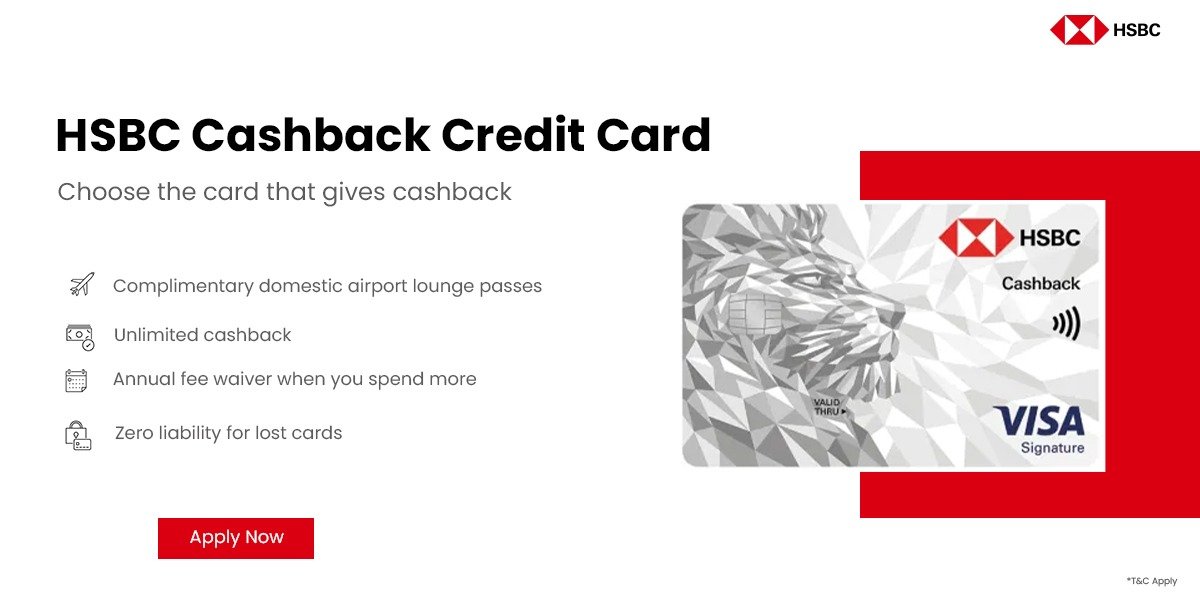

HSBC Credit Cards offer numerous benefits that cover the wide interests of different persons. The greatest benefit is that most such cards do not attract joining and annual fees, which this way is therefore accessible to all income brackets. In addition to these benefits, these cards use the latest technology in their operations, for example, Visa Paywave, a technology that enables an easy, safe contactless payment while buying things without much hustle and still assures safety.

Frequent travelers can enjoy a plethora of benefits provided by HSBC cards, including reward points on travel and expenses, cash backs, and discounts on hotel stays. Foodies can also benefit from the accelerated reward points and special deals at restaurants provided by select cards. For shopaholics, cash back offers and reward programs enable them to save more each time they make a transaction.

The versatility of HSBC credit cards ensures that there’s something for everyone, no matter their spending habits. From managing everyday expenses to enjoying luxury experiences, these cards enhance every aspect of your financial journey

Who Can Apply for an HSBC Credit Card?

Applying for an HSBC credit card is simple, but there are certain eligibility criteria that applicants need to fulfill. The minimum age to apply is 18 years, and the maximum age limit is 65 years. Applicants should have a minimum annual income of ₹4,00,000, making these cards suitable for individuals with steady earnings.

Furthermore, the applicant needs to be residing in one of the major cities of operations of HSBC, such as Mumbai, Delhi, Bengaluru, Chennai, Hyderabad, or Pune. He/She should have an excellent credit score so that he gets approved since that also reflects the customer’s financial responsibility.

What documentation is required?

Documents required for applying for an HSBC credit card are identity verification and stability in finances. Regarding salaried employees, the latest salary slip is called for. If you already have a credit card, then you will have to produce a statement from that card and also attach a photocopy of one side of the card which you hold.

Proof of identity, either in the form of an aadhaar card, passport, or driving license, and proof of residence and PAN card would also be the part of the mandatory paperworks. All these papers would help the process to turn up as smooth and transparent.

Innovative Features of HSBC Credit Cards

HSBC credit cards boast special attractions that make them distinguished from the mainstream competition. For example, large purchases can be easily converted into easy monthly installments, so managing your finances will be easier. This is especially useful during festivals, holidays, or huge purchases.

Another feature is the balance transfer facility, wherein you can transfer outstanding balances from other credit cards to your HSBC card at a reduced rate of interest. This is of value to people who see this as an opportunity to consolidate their debt in one account and thereby save on interest charges.

HSBC Visa Platinum Credit Card

if you lose your card, HSBC provides for an instant replacement any place in the world. Reporting loss through Visa Global Assistance or the HSBC helpline will provide the card within three working days, thus ensuring that your finances are not drastically affected.

Plus, HSBC cards have a zero liability policy. Once you report having lost the card, they will protect you from any unauthorized transactions.

Rewards and loyalty programmes

What makes an HSBC credit card exciting to own is the reward points system. Reward points are awarded for every ₹150 spent on the HSBC Visa Platinum Credit Card. However, you earn even better rewards on dining, hotel, and telecom transactions-promising up to 3X reward points for the first 12 months.

This benefits are much more for constant spenders. For example, you can earn 5X reward points on spends up to ₹ 10,00,000 per annum after spending ₹4,00,000 annually. The points can be redeemed for travel vouchers, discounts at shopping malls, and other things.

Flexible payment options

HSBC Credit Cards offers various options for payment, thereby not being difficult for cardholders to manage timely payments. You can pay by opting for internet banking or even go for auto-debit, wherein your dues get cleared automatically every month. Payments are facilitated in the form of NEFT, BillDesk, and even by drawing cheques and demand drafts.

For those who prefer more modern solutions, HSBC’s NACH (National Automated Clearing House) option allows you to authorize the bank to debit your account for monthly payments seamlessly.

Understanding the Costs Involved

Despite all the advantages of HSBC credit cards, be sure to learn about the associated fees. For example, cash withdrawal charges are up to 2.5% of the trading amount; the minimum fee is ₹300. Late payment charges range between ₹500 and ₹750, depending upon your outstanding balance.

Currency conversion charges are standard among most banks at 3.5% for international transactions. There are duplicate statements, over-limit fees, and sales slip retrieval charges that apply to some situations as well. Being aware of these kinds of charges aids in a better control of your finances.

Why Choose an HSBC Credit Card?

Actually, the HSBC credit cards are not only useful, but they also establish a value preciseness in your spending. They have no joining fees, special rewards, and a strength of security, thus attracting many customers. The earn points on every single rupee spent, the flexible type of payment, or the peace of mind with advanced security measures, HSBC Cards are to fit into any and all financial needs.

How to Apply for an HSBC Credit Card

You can apply for an HSBC credit card via the bank’s website. Select the appropriate card and apply via the form given on the site. Attach all the required documents, and submit your application online. Alternatively, you may walk into the nearest HSBC branch and have the entire process done there.

Your credit card will transform into paper at your registered address in a couple of working days once your application has been approved.

Conclusion

HSBC Credit Cards are more than just credit cards; they are the entry points to a more intelligent yet more rewarding lifestyle with access to versatile features, no joining fees, and great rewards program that cater to all possible financial needs-from travel benefits to cash back shopping or dining discounts. Whatever benefit you prefer, there is one type of credit card from HSBC that fits your requirements.

In fact, you must have at least one HSBC credit card and transact a little, and there you will have the opportunity of enjoying a fruitful, beneficial experience.

Read More: Charlize Theron joins Christopher Nolan’s next film 2026: Release Date, Cast & Plot Details

Instant Loan Without CIBIL Score in 2025: Everything You Need to Know

Braj Verma is a resident of Rajgarh in Madhya Pradesh and is a content writer and freelancer by profession. He has a degree in Political Science from Barkatullah University, Bhopal. He has expertise in subjects like credit cards, banking, loan, insurance, political analysis and digital marketing.