PhonePe Loan Reviews : Financial emergencies can happen unexpectedly, like medical bills, home repairs, or urgent expenses. If you’re using PhonePe in India, you’re in luck! The digital payment platform now offers loans to help you get through these tough times. In this guide, we’ll walk you through how to apply for a PhonePe loan in 2025, and help you make informed financial decisions.

Introduction to PhonePe Loans

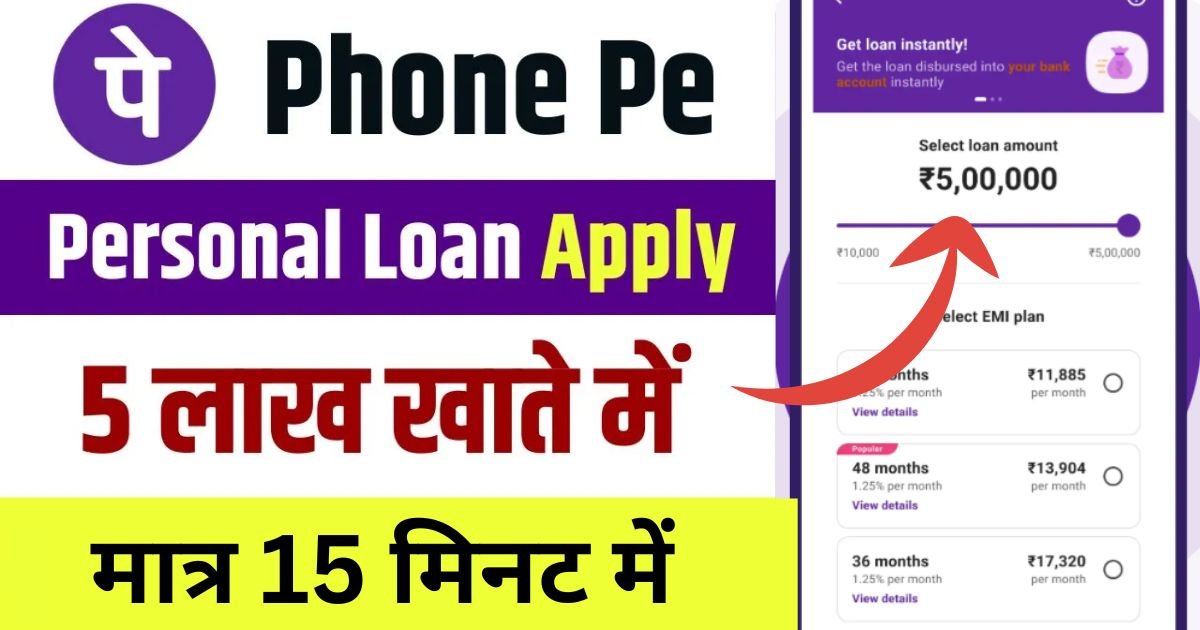

PhonePe is one of the leading digital payment platforms in India, now offering a feature called digital lending. This allows users to apply for loans directly through the PhonePe app. These loans can be used for personal or business needs and are processed quickly, ensuring that you can access funds without hassle.

Key features of PhonePe loans include:

- Instant loan disbursement

- Competitive interest rates

- Flexible repayment tenures

- Minimal documentation requirements

PhonePe collaborates with a number of trusted banks to issue loans. This process is therefore secure, transparent, and fast. The digital lending system ensures that borrowing money is smooth and efficient at any given time.

Eligibility Criteria for PhonePe Loans

To be eligible for the PhonePe loan, one has to meet some eligibility criteria, which include age, income, employment status, and credit score.

- Minimum Age: So, you’ve gotta be at least 21 to apply, and you have to pay back the loan before you hit 65.

- Income & Employment Status: You should have a reliable monthly income of at least Rs. 15,000. This can come from your job, a business, or any other regular cash flow.

- Credit Score: For availing the PhonePe loan, you require a minimum credit score of 650. The higher the credit score, the greater your chances of getting accepted.

| Eligibility Criteria | Requirements |

|---|---|

| Minimum Age | 21 years |

| Maximum Age at Loan Maturity | 65 years |

| Minimum Monthly Income | Rs. 15,000 |

| Minimum Credit Score | 650 |

Providing accurate information during the application process ensures a smoother experience and better chances of approval.

Types of Loans Offered by PhonePe

PhonePe offers two main types of loans:

- Personal Loans:

These loans are designed for individuals to meet personal financial needs. Common uses include:- Medical expenses

- Education costs

- Home renovations

- Debt consolidation

- Travel

- Business Loans:

PhonePe also offers loans tailored for small business owners and entrepreneurs. These loans can help with:- Inventory purchase

- Equipment acquisition

- Business expansion

- Working capital

Both types of loans are designed with flexibility and ease in mind, ensuring that you can get the financial support you need when you need it.

How to Apply for a Loan from PhonePe

Applying for a loan through PhonePe is simple and can be done directly within the app. Here’s a step-by-step guide:

- Open the PhonePe App on your smartphone and log into your account.

- Go to the “Loans” section in the app.

- Select the type of loan you want (personal or business).

- Enter the desired loan amount and select the repayment tenure.

- Provide the required personal and financial information.

- Upload the necessary documents (proof of identity, proof of address, proof of income).

- Review the loan details and submit your application.

- Once approved, the loan amount will be disbursed directly to your bank account.

Documents Required for PhonePe Loan Application

You’ll need to upload these documents to finish up your loan application:

- Proof of Identity (any one):

- Aadhaar Card

- PAN Card

- Passport

- Voter ID Card

- Proof of Address (any one):

- Aadhaar Card

- Passport

- Voter ID Card

- Utility Bills (Electricity, Gas, Telephone)

- Income Proof (any one):

- Salary Slips (last 3 months)

- Bank Statements (last 6 months)

- Form 16 or IT Returns (last 2 years)

PhonePe Loan Interest Rates and Fees

PhonePe offers flexible loan repayment options. You can choose a tenure from 3 months to 36 months, so you can select any plan according to your pocket.

Key charges include:

- Interest Rate: 12% to 24% per annum

- Processing Fee: A one-time fee based on loan size and your profile

- Late Payment Penalty: Applicable if EMIs are not paid on time

- Prepayment Penalty: None (you can repay early without additional charges)

PhonePe is transparent in its fees, with no prepayment penalties or hidden charges. You should keep track of your EMI payments so that you do not pay late fees and lose your credit score.

Loan Repayment Options and Terms

PhonePe offers flexible repayment options for its loans. You can choose a repayment tenure ranging from 3 months to 36 months. This gives you the flexibility to pick a plan that fits your budget.

- Prepayment Option: If your financial situation improves, you can pay off the loan early without any extra charges, saving on interest.

Benefits of Choosing PhonePe Loans

Here’s why you should consider PhonePe Loans:

- Instant Loan Disbursement: Funds are credited to your account within minutes after approval.

- Competitive Interest Rates: Enjoy lower rates that are based on your credit profile.

- Minimal Documentation: Less paperwork required compared to traditional loan providers.

- No Hidden Charges: Transparency in fees and charges.

- Flexible Repayment Terms: Choose from a range of repayment tenures.

Customer Support

PhonePe offers dedicated customer support for all loan-related queries. You can reach the support team through:

- In-app chat

- Email support

- Toll-free helpline number

PhonePe Loan Reviews

Many users have praised the PhonePe loan service, stating that it is quick and easy to apply for with low interest rates. Some users have requested higher loan amounts and longer repayment options. Overall, the feedback has been positive, especially for those seeking quick access to funds.

Disclaimer: The information provided in this article is for general informational purposes only. Loan terms, eligibility criteria, and interest rates are subject to change at the discretion of PhonePe or its partnered financial institutions. Please verify all details with PhonePe directly before making any financial decisions. Borrow responsibly.

Braj Verma is a resident of Rajgarh in Madhya Pradesh and is a content writer and freelancer by profession. He has a degree in Political Science from Barkatullah University, Bhopal. He has expertise in subjects like credit cards, banking, loan, insurance, political analysis and digital marketing.