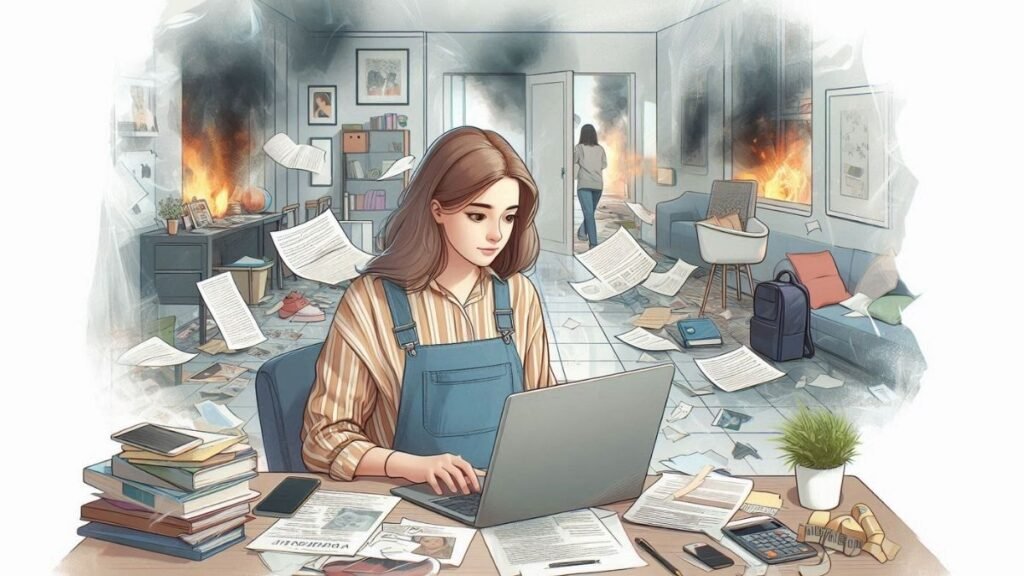

Renters insurance is one of those things that is easily disregarded, but it is a low cost purchase that can prevent large financial loss. This can be insuring your stuff or compensating for unexpected costs; it does not come as a surprise to understand why renters insurance is wise. A lot of renters tend to think that it is unnecessary but here is what makes opting out of renters insurance a big blunder. Let’s discuss the importance of and the expenses associated with it and determine its costs.

6. Your Landlord’s Insurance Doesn’t Protect You

One of the widespread myths about tenancy is that everything is included in the landlord’s insurance, including the tenants’ possessions. Nevertheless, a landlord’s insurance protects only the structure and not the contents of the tenant’s apartment. In a NerdWallet poll, 13 percent of those surveyed assumed their landlord’s policy also included their belongings, which is untrue.

What if an event like a fire, theft or even water damage took place, for instance? In such a case, without renters insurance, everything will need to be replaced at your own cost. However, renters insurance can also cover you should you face any legal battles. For instance, if the water from your bathtub overflows and damages the apartment underneath, your landlord will not pay for the repairs, but will use the renters insurance coverage to protect you against costs from repair as well as any complaints that may arise from the damage. A typical renters insurance cover comes with liability coverage of at least $100,000 which protects the insured against that risk.

| What’s Covered by Insurance? | Landlord’s Insurance | Renters Insurance |

|---|

| Damage to the Building | Yes | No |

| Damage to Personal Belongings | No | Yes |

| Liability for Damage to Neighboring Property | No | Yes |

| Temporary Housing Costs (after a disaster) | No | Yes |

5. You Probably Own More Than You Think

Most of the tenants think that they do not have enough valuable possessions which will need them to seek insurance. But again it also comes to the fact that with all this, one’s belongings might actually have some value. Television set, clothes, carpets, home deaths, cooking utensils thas summouned can present quite a bill in terms of their restoration to normal state. You can underestimate the overall worth of your things until the moment when you actually need to count them all.

Professionals advise everyone to create a list of their possessions. Visit every part of the house, every room and even every piece of furniture. After you’ve added up the expense of all the electronics, clothing and footwear, other furniture included, the extent of loss becomes obvious. Renters insurance is available so that replacing such items will not have to be borne if all goes awry.

4. The Renters or Tenants Insurance also Includes Relocation Expenses

Should an unfortunate event such as a fire outbreak or an incidence of severe flooding render your apartment structure unfit for habitation, all rented apartment unit and renters insurance will often come flat out for coverage of living accommodations on an extra expense basis. This type of coverage is called “differential of use,” and it means that you do not have to bear the costs of staying in a hotel, buying food, or incurring other expenses that are related to spending some time away from one’s residence.

In the absence of this cover, you may have to remain out of pocket for hunched of hard dollars even thousands until the restoration of your house is finished. The renters insurance comfort s him or her in those difficult times and makes sure the person doesn’t incur these costs.

3. It Protects You from Financial Losses and Lawsuits

Les assurances locatives ne se limites pas souvent à la dédommagement des meubles ou des objets mais aussi protect against liability. What this assessment entails is that if someone gets hurt in your house or if you happen to break someone’s property, then the insurance cover can pay for the treatment or repair respectively.

Here is the example of such situation. While playing golf, you strike another golfer with a golf ball. They later decide to take you to court demanding that you pay their medical bills after renting. The legal expenses incurred, to the extent that they do not exceed the policy limit, are covered by the renters insurance. This coverage also applies outside your house which means you will be covered whenever you are not home. A policy like this can also be useful in case of mishaps like your pet biting someone or when your child breaks something expensive at a friend’s place.

2. Your Belongings Are Covered When They Are Outside Your House

Another good thing about renters insurance is that most of the time, it helps to protect your things, even if they are not at home. For example, if you are in a coffee shop and someone steals your laptop, or you are on a subway and someone takes your phone from you, your insurance policy can pay you back. That way, you know you are safe no matter where you are.

On top of that, every now and then, renters insurance includes the belongings kept in external storage facilities. In case you have belongings that are not in your main house, this can offer additional comfort. It is important to note, however, that it may not always make sense to submit a claim, especially if the item lost or damaged is not greater than your deductible.

1. There Is Nothing Pricier To Tran Overwrite Than Renters Insurance

People tend to shy away from these policies because of the cost attached to them. However, in most cases, it isn’t true that renters insurance is exhorbitantly priced. Citing Nerdwallet, the average annual expense incurred by renters insurance in the United States is $148.or averaging approximately $12 in a month.

There is financial benefit of combining your renters policy with other insurances like the motor vehicle one hence reducing the cost further. Multi Policy discount is quite common in many insurance companies and it is that which enables you to enjoy policies at a lower scaled up price. For instance, a 5 percent slashing on a three thousand dollars motor policy equals to one hundred and fifty dollars which is enough to pay for the average renters insurance cover.

If your apartment has smoke alarms, burglar alarms, deadbolt locks or other safety devices, you can also qualify for discounts. With such a low amount to pay every month, renters insurance can be of great help during crises because it helps in relieving stress.

Conclusion

For a few bucks, you can replace your fallible self with robbery insurance. It is rented house insurance also known as abbreviated renters insurance. In the United States, its monthly premium can be as low as twelve dollars. No, do not think it is a scam, out of one hundred and thirty two respondents who had used this insurance clusters only ten reported eighty one claims during one survey year. Remember why this cover is important when you feel irritated and tempted about getting it, do not give up.

Renters insurance is no longer a luxury or an afterthought. It is a sensible, necessary purchase for the modern age that will protect your interests.

Braj Verma is a resident of Rajgarh in Madhya Pradesh and is a content writer and freelancer by profession. He has a degree in Political Science from Barkatullah University, Bhopal. He has expertise in subjects like credit cards, banking, loan, insurance, political analysis and digital marketing.